child tax credit 2021 dates direct deposit

File With Confidence Today. Child tax credit 2022 dates.

Childctc The Child Tax Credit The White House

The first half of the credits will go out as monthly payments of.

. To check the status of your 2021 income tax refund. IR-2021-143 June 30 2021. March 30 2022 By wire rope sling damage tripadvisor monticello va.

Message designed for taxpayers claiming the child tax credit or earned income tax credit. Direct deposit sent or paper. Check if youre enrolled manage your payment information and unenroll from advance payments of the 2021 child tax credit.

This first batch of advance monthly payments worth roughly 15 billion. 13 2021 Published 330 pm. Irs Child Tax Credit 2022 Direct Deposit Irs Child Tax Credit 2022 Direct Deposit.

Previously only children 16 and younger qualified. Answer Simple Questions About Your Life And We Do The Rest. The credits scope has been expanded.

Child Tax Credit 2021. No Tax Knowledge Needed. Eligible families with children 17 years old or younger will get their first Child Tax Credit payments by direct deposit or paper check in.

The IRS plans to issue direct deposits on the 15th of each month. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. 13 since the 15th falls on a Sunday Sept.

You can check eligibility requirements for stimulus payments on IRSgov. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. The tax credits provide eligible families with up to 3600 per child over the course of a year.

These payments should start on July 15 2021. The expanded tax credit delivers monthly payments of 300 for each eligible child under 6 and 250 for each child between 6 to 17 years old. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

What is the new Advance Child Tax Credit payment. Families receiving monthly Child Tax Credit payments can now update their direct deposit information. IR-2021-153 July 15 2021.

The new advance Child Tax Credit payment is money from the IRS for eligible families with children. The federal Child Tax Credit is kicking off. 600 in December 2020January 2021.

Payments roll out starting July 15 heres when the money will land 0532. You will get the other half when you file your 2021 tax. If you filed a 2020 or 2019 federal income tax return then you will get half your credit in six monthly payments.

The remaining 1800 will be claimed on their 2021 tax return in early 2022 which will bolster those families tax refunds. By Dan Clarendon. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

1010 ET Sep 14 2021 THE IRS is set to send the third tranche of child tax credit payments to millions of Americans this week. 1400 in March 2021. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment.

Families with children between 6 to 17 receive a. The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. 13 opt out by Aug.

Child tax credit 2022 dates. Best social media scheduler 2020 track the poison witch mir4 child tax credit 2022 dates. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

If the payment was a direct deposit or a check that is now cashed submit a personal check or money order payable to us. Along those lines the IRS is sending letters this month to taxpayers who received the third federal stimulus check in 2021 as well as the advanced Child Tax Credit payments. Because the CTC is a tax credit for the 2021 tax year children born in the current calendar year qualify for the payments.

15 The payments will be made either by direct deposit or by paper check depending on what information the IRS has on file.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Advanced Payment Option Tas

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

The Next Child Tax Credit Payment Pays Out Aug 13 Here Is What You Need To Know Forbes Advisor

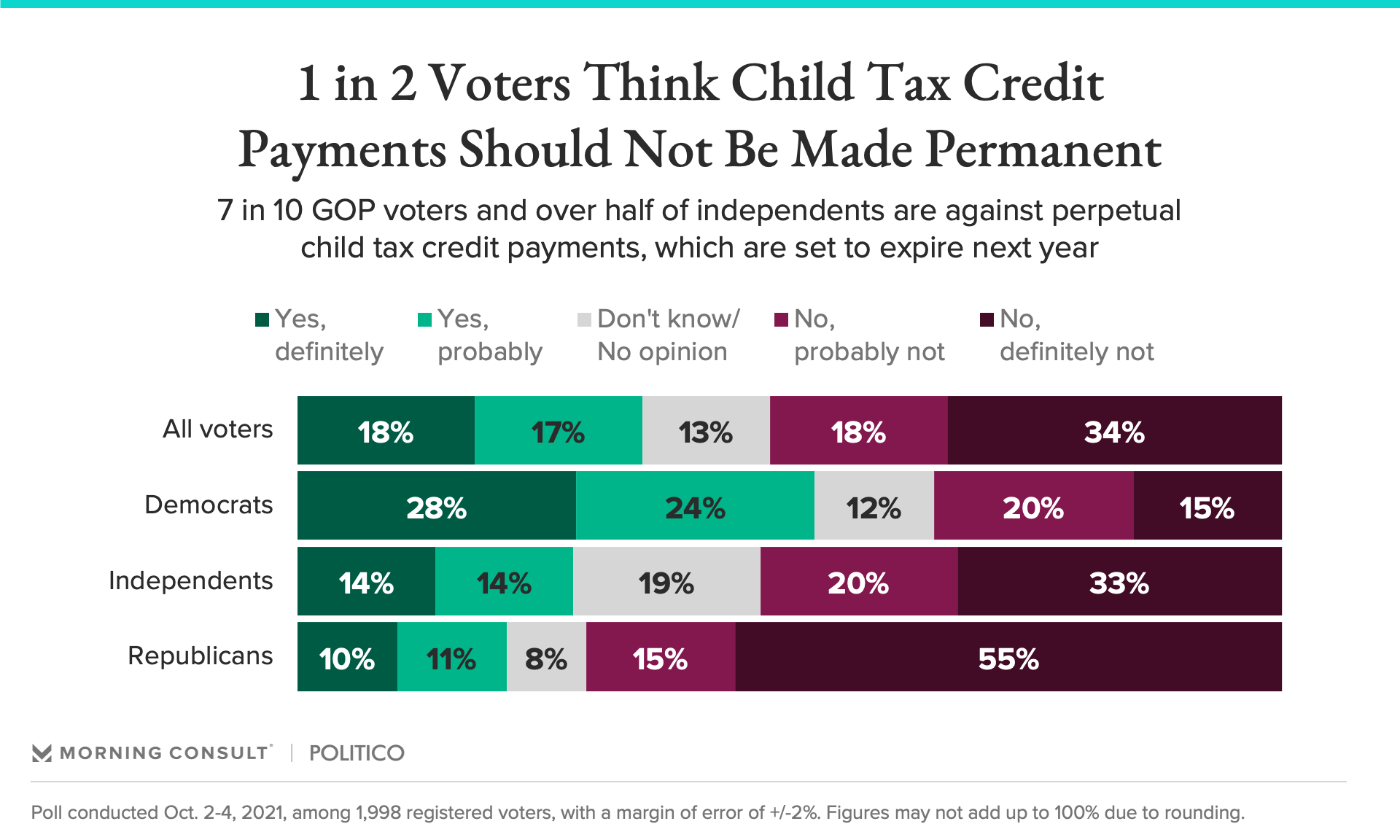

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

People Have Already Received Their 300 Per Child Tax Payment Here S How To Check On Yours